The payroll cycle in Mexico varies depending on the industry, the type of employment contract, and the company’s policies. Understanding the different payroll cycles and their implications is essential for both employers and employees. This guide explores the three primary payroll cycles in Mexico: weekly, bi-weekly, and monthly, highlighting their advantages and disadvantages.

Types of Payroll Cycles

Weekly Payroll Cycle

In a weekly payroll cycle, employees are paid once a week. This cycle is commonly used in industries like manufacturing, construction, and hospitality, where work hours can fluctuate significantly from week to week.

Advantages for Employees:

- Frequent Pay: Employees receive their wages more frequently, which can help with managing day-to-day expenses and cash flow.

- Immediate Compensation: Workers see immediate compensation for their work, which can be motivating.

Advantages for Employers:

- Reduced Liability: By paying employees more frequently, employers reduce the liability of holding large amounts of unpaid wages.

- Motivation and Retention: Frequent pay can improve employee satisfaction and retention.

Disadvantages for Employees:

- Smaller Paychecks: The paychecks are smaller, which might make it harder to save or manage larger expenses.

Disadvantages for Employers:

- Administrative Burden: Processing payroll weekly increases administrative workload and costs.

Bi-Weekly Payroll Cycle

A bi-weekly payroll cycle involves paying employees every two weeks. This is the most common payroll cycle in Mexico and is used across various industries.

Advantages for Employees:

- Regular Income: Provides a predictable and regular income, making it easier to budget and plan expenses.

- Balanced Work-Life: Employees get paid for every two weeks of work, which can align better with work schedules and personal time management.

Advantages for Employers:

- Reduced Payroll Processing: Compared to weekly payroll, bi-weekly payroll reduces the number of times payroll needs to be processed, saving time and administrative costs.

- Consistency: Easier to manage and plan cash flow due to predictable payroll dates.

Disadvantages for Employees:

- Less Frequent Pay: Less frequent than weekly pay, which might be a drawback for those who prefer more immediate compensation.

Disadvantages for Employers:

- Higher Payroll Liability: Employers hold wages for a longer period, increasing their financial liability.

Monthly Payroll Cycle

In a monthly payroll cycle, employees are paid once a month. This cycle is less common in Mexico but is used in some sectors like executive roles or certain professional services.

Advantages for Employees:

- Larger Paychecks: Employees receive a larger amount at once, which can be easier for managing larger expenses and savings.

- Simplified Budgeting: Can simplify budgeting for those who have monthly bills and expenses.

Advantages for Employers:

- Administrative Efficiency: Reduces the frequency of payroll processing, cutting down on administrative workload and costs.

- Improved Cash Flow Management: Allows employers to better manage cash flow, as payroll is processed only once a month.

Disadvantages for Employees:

- Financial Management: Employees need to manage their finances carefully to ensure their funds last throughout the month.

- Delayed Compensation: Longer gaps between paychecks can be challenging for those with immediate financial needs.

Disadvantages for Employers:

- Increased Liability: Employers hold wages for a longer period, increasing financial liability and the risk associated with it.

- Potential for Dissatisfaction: Employees might be less satisfied with less frequent pay periods.

Choosing the Right Payroll Cycle

Industry Norms:

Industries with fluctuating work hours, like construction and hospitality, might benefit more from weekly payroll.

Professional services and executive roles might align better with monthly payroll due to the nature of work and compensation structures.

Employee Needs:

Employees with immediate financial needs may prefer weekly or bi-weekly payroll cycles.

Those who are better at financial planning might appreciate the larger, less frequent paychecks of a monthly cycle.

Administrative Capacity:

Employers must consider their administrative capacity to handle payroll processing. Weekly payrolls require more frequent processing, which can be a significant burden.

Financial Management:

Employers must also manage their cash flow and financial planning to ensure they can meet payroll obligations on time, regardless of the chosen cycle.

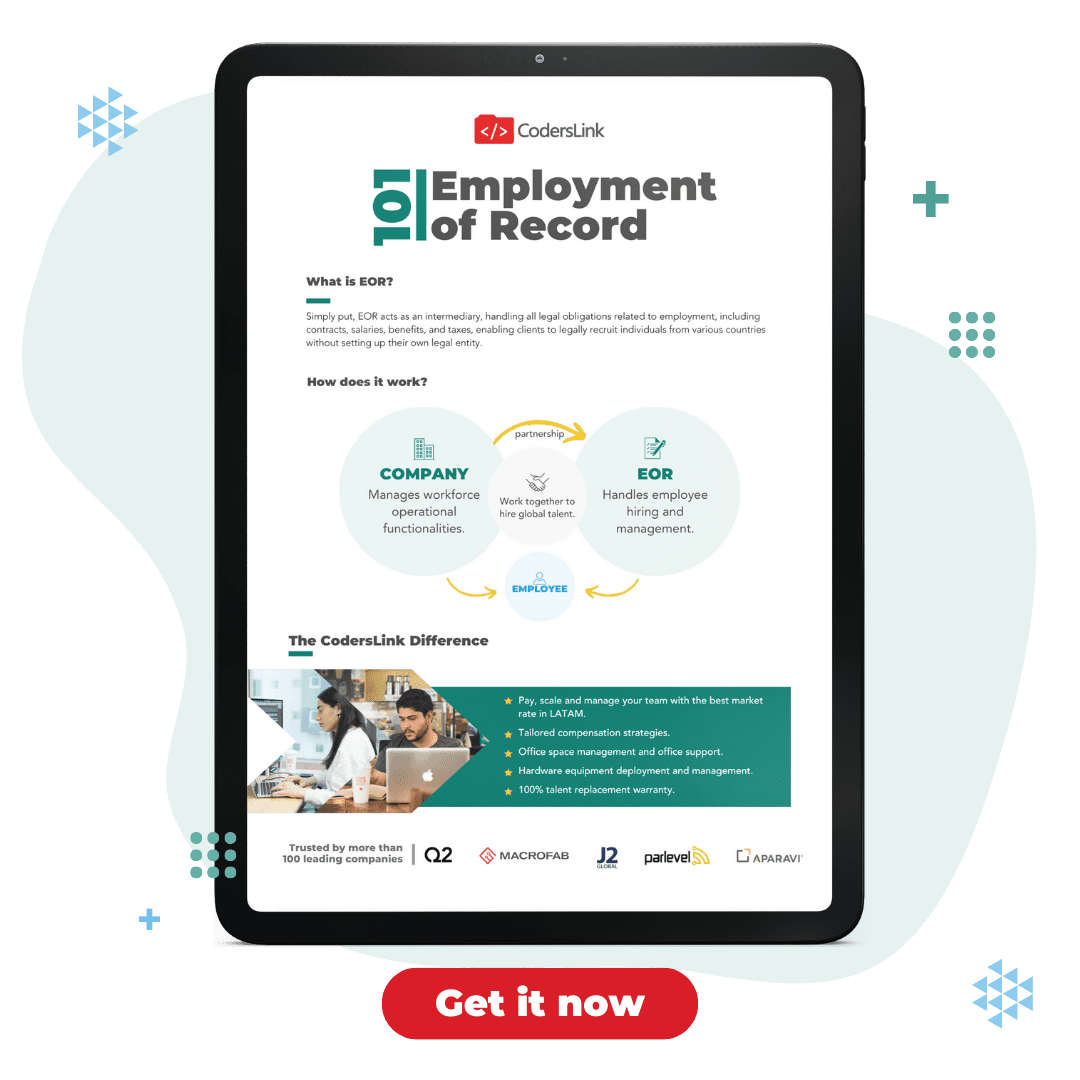

Simplifying Payroll with CodersLink’s Employer of Record (EOR) Services

Managing payroll in Mexico can be complex due to varying payroll cycles, compliance requirements, and administrative burdens. CodersLink’s Employer of Record (EOR) services offer an efficient solution to these challenges. By leveraging EOR services, businesses can simplify payroll management, ensure compliance with local regulations, and focus on their core activities.

Benefits of Using CodersLink’s EOR Services:

- Quick Hiring and Onboarding: Hire and onboard international talent quickly without setting up local entities.

- Compliance Assurance: Meet all local employment regulations, tax laws, and contracts without added overhead.

- Competitive Benefits: Provide an excellent employer experience with locally competitive benefits and perks.

- Scalability: Expand to new talent markets and build diverse tech teams efficiently.

- Cost-Effective Solutions: Avoid time and money spent on legal, fiscal, and tax implications.

To learn more about how CodersLink’s EOR services can streamline your payroll processes and help you expand your team in Mexico, schedule an EOR discovery session with a specialist today.