Mexico’s tech industry is roaring! and companies hiring software programmers are flocking to Mexico, a country fueled by a thriving tech ecosystem. The demand for software programmers in the country is reaching unprecedented levels, making it a global player in the digital revolution. This surge is driven by several key factors: nearshore software development, significant improvements in technical infrastructure, a booming economy, and strong government initiatives supporting the IT industry.

This robust tech sector has fostered a network of local tech hubs, making Mexico an increasingly attractive destination for multinational companies seeking top-notch software developers. With a tech talent pool that’s both skilled and culturally aligned, Mexico offers a unique advantage – cost-effective and efficient software development solutions for global firms.

Here’s why Mexico is a hotbed for software development:

- Nearshore Software Development: Mexico’s proximity to the US makes it an ideal location for companies seeking a geographically close outsourcing partner, offering clear communication and time zone advantages.

- Booming Tech Industry: Mexico’s tech sector is experiencing explosive growth, creating a dynamic environment for innovation and attracting top talent.

- Expanding Tech Talent Pool: Government initiatives and a strong focus on STEM education are fueling a rapidly growing pool of highly skilled software developers in Mexico.

- Economic Growth in the Tech Sector: Mexico’s robust economy provides stability and fosters a strong tech infrastructure, making it a reliable choice for software development projects.

Economic Growth and Technological Advancements

For more than a decade now, Mexico has maintained an average GDP growth rate of 2-3% each year. This economic stability has provided fertile ground for investment in the Mexico tech industry, which has experienced explosive growth. As such, there’s a projection that the country’s economy will continue to grow further because of ongoing diversification efforts set up to steer Mexico’s economy from the conventional agricultural and mining sectors. Therefore, this economic stability provides fertile ground for investment in the tech sector.

Furthermore, digital technologies such as artificial intelligence (AI), cloud computing, and blockchain have caused an upsurge in demand for software programming skills worldwide.

To meet this demand as it arises, Mexico is making use of various skilling initiatives. This has led to the emergence of public-private partnerships aimed at upskilling developers on cutting-edge technologies. Several factors have contributed to the increased demand for skilled software programmers and developers in Mexico over time.

Economic Diversification

As Mexico diversifies its economy beyond agriculture and mining, the technology and software development sector has become a key priority area. Numerous initiatives are underway to transform Mexico into a regional tech and innovation hub. This is massively driving demand for programmers.

Expanding Domestic Market

With a population of almost 130 million and rising household incomes, Mexico also offers a sizable domestic market for software products and services in domains like financial services, e-commerce, logistics, and more. Meeting the needs of local Mexican firms requires expanding the talent pool.

Nearshoring Trend

Outsourcing software development to Mexico through nearshoring has become immensely popular with North American companies. This is significantly contributing to demand as US and Canadian firms hire thousands of programmers remotely from Mexico for cost efficiencies. Mexico’s labor costs are significantly lower than the US, making it an attractive option.

Government Investments

The Mexican government’s substantial investments into technology infrastructure and skill development initiatives are directly enabling a larger pool of qualified software engineering graduates catering to local and foreign tech companies. Economic and policy factors have made Mexico a regional technology hub fueling rising demand for software developers across sectors.

Government Initiatives and Support

The Mexican government has been actively introducing policies and initiatives to boost the domestic technology and software development sector. It has invested over $32 billion in telecommunications infrastructure and IT services over just the past six years.

The government has also set up special economic zones with attractive tax incentives to catalyze investments from global tech companies. Additionally, funding programs such as Startup Mexico and Mexico Ventures have been launched to help nurture homegrown Mexican startups.

Simplified business incorporation processes, friendly visa regulations, and seed funding schemes have been successful in attracting foreign tech firms and entrepreneurs to Mexico as well. Such sustained policy interventions and government support have been critical for elevating Mexico’s technology sector.

Impact of Nearshoring

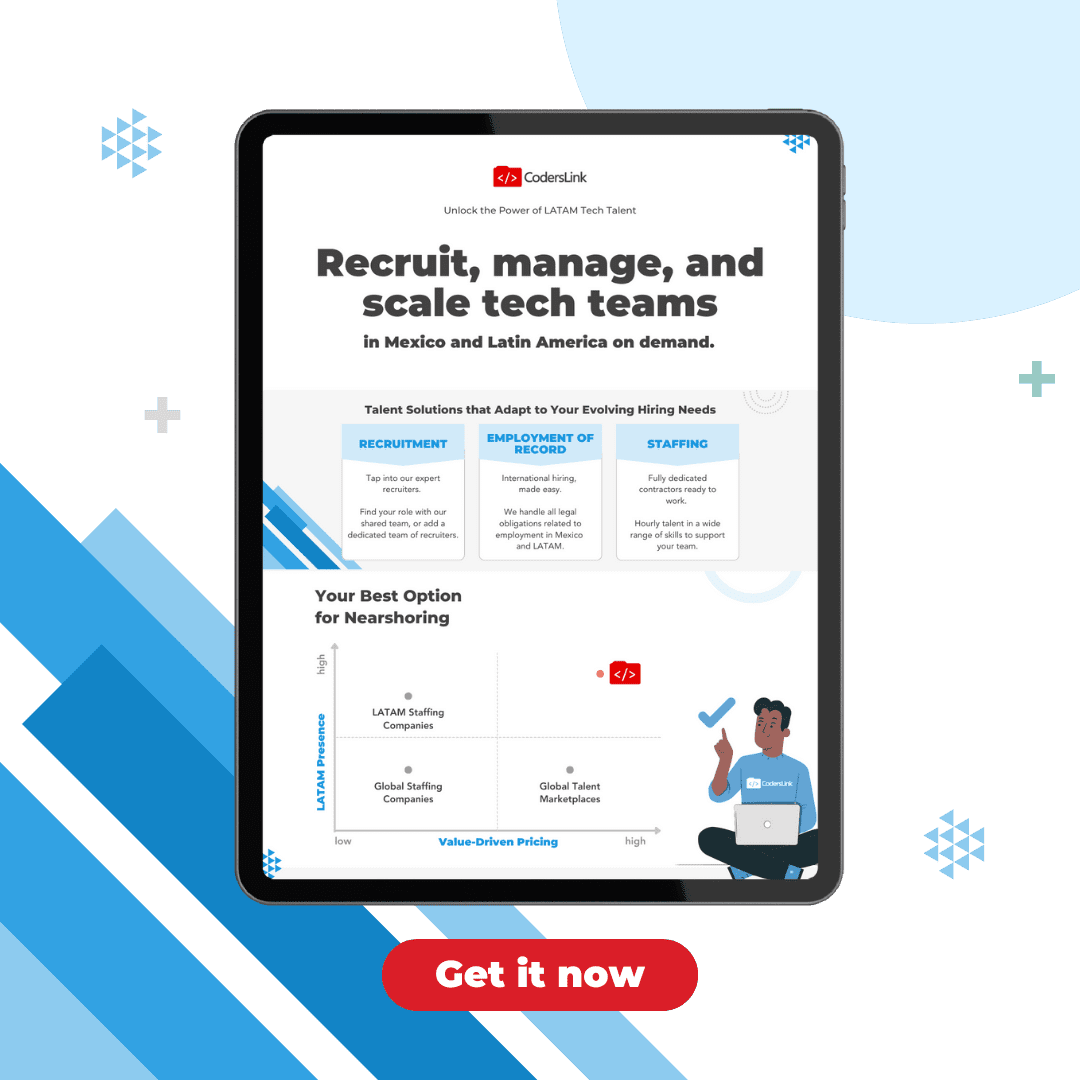

Nearshoring refers to the business practice of offshoring IT functions and processes to countries that are in close geographic proximity. For US and Canadian companies, nearshoring typically involves utilizing talent from countries like Mexico and South America.

Nearshoring provides greater cost efficiencies over domestic options and allows closer collaboration than traditional offshoring to India or Asia.

Difference Between Offshoring and Nearshoring

The key differences between offshoring and nearshoring lie in the geographic and cultural proximity between client and vendor organizations. Nearshoring destinations tend to have greater alignment with North American culture, similar time zones for overlapping workdays, and easier site visits or travel.

Mexico offers unmatched advantages as a nearshore location from a United States and Canada perspective. Its cultural affinity, talent pool, reduced costs, and travel connectivity make it ideal for companies seeking software development support.

Salaries for skilled programmers and developers can be as much as 30-50% cheaper in Mexico than in the US. English proficiency is also higher on average here than in other LatAm countries.

Companies Nearshoring in Mexico

Many global companies across Mexico’s banking, financial services, healthcare, e-commerce, logistics, and other domains have already established large software application development and testing centers.

For example, leading North American banks like Citigroup, Bank of America, and Wells Fargo have over 10,000 tech employees based across different Mexican cities working on critical applications like mobile banking and payment systems.

Retail giants like Walmart and Amazon also leverage thousands of software engineers from Mexico to develop next-generation e-commerce platforms and supply chain systems to service US markets. Mexico serves as a natural extension of its US technology teams, with aligned working hours and geographic time zones.

These companies actively hire and train local Mexican software engineering talent on the latest technologies and innovations emerging in Silicon Valley and worldwide.

Other companies benefiting significantly from Mexican nearshore talent include:

HP: Nearshored product testing and customer support services to Mexico supporting over 50 million US customers at 30-40% cost savings.

Oracle: Established a major software development center in Mexico with 1,500 engineers working across cloud, database, and enterprise solutions.

Boeing: The software and aerospace engineering team in Mexico conducts modeling, analytics, and design for planes made in US factories.

Dell: Leverages Mexican IT talent for managing help desk, cloud migration, and application integration projects across Dell’s global operations.

As globalization enabled remote work models to gain traction, nearshoring into Mexico will continue rising given the country’s unique combination of cost, talent, and proximity factors from a US perspective.

With strong program management, North American companies can drive significant efficiency and quality gains by building out Mexican technology teams aligned with their strategic objectives.

Workforce Development and Tech Talent Pool in Mexico

Mexico has invested heavily in developing a talent pipeline to meet the rising technology skills demand within the country.

This strategic investment in Mexico’s tech talent pool can be viewed as a long-term play, similar to a Build-Operate-Transfer (BOT) approach in infrastructure development. Fostering a strong team in Mexico can yield significant returns over time.

Building Domestic STEM Capacity for Sustainable Tech Growth

Mexico has a significant emphasis on building domestic capacity in Science, Technology, Engineering, and Mathematics (STEM) to ensure sustainable growth of Mexico’s tech sector. Specifically, Mexico now produces over 130,000 qualified graduates every year in STEM-related college programs.

Rise in Technology-Focused Higher Education

There has been a sharp increase in students pursuing computer science, software engineering, information technology, and other specialized technology-focused courses, including machine learning, at Mexican universities over the past decade. This helps guarantee a steady supply of skilled programmers and developers that global tech firms nearshoring to Mexico can access.

Furthermore, the Mexican workforce is generally quite comfortable working seamlessly with cross-border teams and overseas clients predominantly from countries like the US and Canada.

English Proficiency Among Graduates

Fluency in the English language is relatively higher on average among Mexican graduates compared to other countries in Latin America. This is driven by increased emphasis on English-language instruction in higher education and greater integration with North American companies operating in Mexico.

Especially among recent graduates of Mexican colleges, the English proficiency levels are high making them primed for nearshore arrangements servicing American clients.

Global Tech Giants Establishing Roots in Mexico

The leading global technology companies and multinationals like Oracle, IBM, SAP, Intel, Cisco, and others have already established large delivery centers across major Mexican cities. These companies actively hire and train local Mexican software engineering talent on the latest technologies and innovations emerging in Silicon Valley and worldwide.

Investments made by these firms help elevate the capabilities of Mexican programmers and developers to be on par with the best in the industry globally. It also offers them exposure while serving international clientele through offshore delivery models.

Government Initiatives Boosting Tech Education

The Mexican government has been a strong catalyst as well. The goal is to institutionalize cutting-edge curriculum design and learning infrastructure for generating world-class computer science graduates at scale.

Government funding for tech skilling and partnerships with leading corporations are collectively helping expand Mexico’s talent pool – creating a win-win for both domestic and foreign tech companies eyeing expansion in Mexico.

Hence, concerted efforts towards utilizing public-private partnerships, foreign tech investments, and strategic skilling initiatives have all elevated Mexico’s technology workforce development programs significantly.

The emphasis is on building domestic capacity and growing the pool of qualified, industry-ready software programmers primed to drive innovation in Mexico’s booming technology landscape.

Challenges and Considerations

Companies still need to be adequately prepared to address some cultural gaps that may exist while managing Mexican talent. Mexican workplace culture tends to traditionally be more formal and hierarchical versus the flat, casual work environments commonly found in North America.

Proactively fostering open communication, transparency, and comfort across borders is vital for effectively leveraging Mexican software developers in nearshore arrangements.

The region has some logistical considerations around travel, shipping, and infrastructure dependencies that companies should factor in. Although Mexico’s infrastructure is well-developed, travel requirements between office locations might need more planning.

Finally, ensuring rigorous data security and compliance protocols are adhered to especially when managing sensitive client information cross-border also requires due diligence.

Conclusion

A compelling case exists for considering Mexico as both a regional technology hub and a nearshore destination of choice for hiring software programmers.

Sustained economic growth, supportive government policies, and concerted workforce development efforts have collectively positioned Mexico’s tech sector for continued success – especially in software engineering domains.

North American firms stand to benefit tremendously from leveraging this combination of geographic, cultural, and talent-based proximity that Mexico offers. With strong change management practices, nearshoring software development projects to Mexico can deliver immense strategic value.