Employer payroll fraud is a serious issue in Mexico, with various tactics used to exploit the system. Understanding these fraudulent activities can help employers and authorities take preventive measures to ensure compliance and fairness. Here are some common types of payroll frauds in Mexico:

Misclassification of Employees

Misclassification of employees as independent contractors is a significant issue in Mexico, leading to severe financial and legal consequences for employers. Here’s an in-depth explanation of what this entails and its implications:

What is Misclassification?

Misclassification occurs when an employer incorrectly classifies a worker as an independent contractor instead of an employee. This misclassification allows employers to avoid paying various benefits and taxes, such as social security contributions, healthcare, and other mandatory employee benefits.

Criteria for Classification

Employees: In Mexico, an employee is defined as someone who performs work under a subordinated relationship with the employer. This means the employer has the authority to direct and supervise the employee’s work, set work hours, and provide tools and equipment necessary for the job. Employees are entitled to various legal protections and benefits under Mexican labor law, including minimum wage, paid leave, retirement benefits, social security, overtime pay, and profit sharing.

Independent Contractors: Independent contractors, on the other hand, have more control over their work, including how, when, and where it is done. They provide their tools and are paid upon invoicing for completed work. They are not entitled to the same statutory benefits as employees and are responsible for their taxes.

Common Practices and Legal Implications

Avoiding Contributions: By classifying workers as independent contractors, employers can avoid paying social security, healthcare, and other contributions required by law for employees. This can result in substantial savings but is illegal and risky.

Legal Risks and Penalties: Misclassification can lead to significant penalties, including:

- Back pay and benefits owed to misclassified employees.

- Government fines ranging from hundreds of thousands to millions of pesos.

- Severance pay requirements for terminated workers who were misclassified.

- Legal actions and damages claimed by workers.

- Criminal charges for tax fraud and evasion.

Recent Developments: As of January 2022, misclassifying employees is considered tax fraud, subjecting employers to criminal sanctions. This underscores the importance of correctly classifying workers and adhering to legal standards.

Reporting Lower Wages to IMSS (Social Security Agency)

In Mexico, some employers engage in the fraudulent practice of reporting lower wages to the Mexican Social Security Institute (IMSS) than what is actually paid to employees. This tactic is used to reduce the amount that employers must contribute to social security and other benefits, effectively minimizing their payroll expenses.

How It Works

When employers underreport wages, they declare a lower salary to IMSS while paying the employee a higher amount off the books. For instance, if an employee is paid $20,000 MXN per month, the employer might report only $10,000 MXN to IMSS. This allows the employer to reduce their mandatory contributions, which include payments for health care, disability, retirement, unemployment insurance, and housing funds.

Implications for Employees

Reduced Benefits: Employees receive lower benefits because social security contributions are calculated based on the reported salary. This affects their future pensions, disability benefits, and access to healthcare services.

Legal Risks: Employees who are aware of this practice and do not report it may face legal consequences if discovered, as they are complicit in the fraud.

Job Insecurity: Employers engaging in such practices often operate in a way that undermines trust and job security, leading to a precarious working environment.

Implications for Employers

Legal Penalties: If caught, employers face significant fines and legal action. Penalties can range from three to 315 times the locally established minimum wage for each violation.

Reputation Damage: Engaging in fraudulent payroll practices can severely damage an employer’s reputation, making it difficult to attract and retain talent.

Financial Risks: In the long run, the costs associated with legal battles, fines, and the potential for back payments to social security can far outweigh the short-term savings from underreporting wages.

Wage Theft

Wage theft refers to the unlawful practice where employers do not pay workers the wages they are legally owed. This can occur through various means, such as not paying overtime, making illegal deductions, paying below the minimum wage, or failing to pay for all hours worked. In Mexico, wage theft is not only illegal but also significantly harmful to employee morale and productivity.

Types of Wage Theft

Overtime Violations: Employers fail to pay the legally required overtime rates for hours worked beyond the standard workweek. This often includes not keeping accurate records of hours worked.

Minimum Wage Violations: Employers do not adhere to the minimum wage laws, paying employees less than what is mandated by law.

Illegal Deductions: Employers deduct money from employees’ paychecks for unauthorized or unlawful reasons, such as for uniforms, equipment, or penalties.

Off-the-Clock Violations: Employees are required to work before or after their scheduled shifts without being compensated for that time.

Rest Break Violations: Not providing or improperly deducting pay for mandated meal and rest breaks.

Common Practices of Wage Theft

Misclassification of Employees: Employers classify workers as independent contractors rather than employees to avoid paying benefits and taxes, including contributions to social security and healthcare.

Reporting Lower Wages to IMSS: Some employers report lower wages to the Mexican Social Security Institute (IMSS) than what is actually paid to employees. This reduces the amount the employer has to contribute to social security and other benefits, effectively underreporting their payroll expenses.

Wage Theft: This can involve not paying employees for overtime, making illegal deductions from paychecks, or not paying the minimum wage. Wage theft is detrimental to employee morale and productivity and is a violation of labor laws.

Failure to Pay Mandatory Benefits: Employers do not provide legally required benefits such as holiday pay, vacation pay, and severance pay, thereby reducing their payroll costs unlawfully.

Inflating Payroll for Tax Benefits: Employers might inflate their payroll expenses to take advantage of tax benefits, leading to fraudulent financial reporting.

Ghost Employees: Creating fictitious employees on the payroll to divert funds for personal gain.

Commission and Bonus Manipulation: Manipulating the calculation of commissions and bonuses to pay employees less than what they are entitled to.

Third-Party Payroll Scams: Engaging third-party payroll services that engage in fraudulent activities, such as skimming off employee wages or not reporting accurate payroll data.

Manipulating Contract Information: Providing misleading information on employment contracts to avoid paying full severance benefits upon termination.

Legal Consequences

Employers found guilty of wage theft in Mexico face severe legal consequences, including fines, back pay, and penalties. Legal actions can be taken by employees to recover stolen wages and seek damages for the illegal actions of their employers. Regulatory bodies such as the IMSS and labor courts play a crucial role in enforcing compliance and protecting workers’ rights.

Failure to Pay Mandatory Benefits

Employers in Mexico are required by law to provide several mandatory benefits to their employees. Failing to do so can lead to significant legal penalties and damage to the employer’s reputation. Here are some of the key mandatory benefits and the implications of not providing them:

Vacation Pay

According to Mexico’s Federal Labor Law, employees are entitled to paid vacation days. This begins at 12 days after one year of service and increases with the length of employment. In addition to the vacation days, employees must receive a vacation premium of at least 25% of their base salary during the vacation period.

Christmas Bonus (Aguinaldo)

Employers must pay their employees a Christmas bonus equivalent to at least 15 days of their salary, and this must be paid by December 20 each year. Even employees who have worked less than a year are entitled to a proportional part of this bonus.

Profit Sharing

Employers in Mexico are required to distribute 10% of their annual pre-tax profits among their employees. This distribution must occur within 60 days of filing the company’s annual tax return.

Severance Pay

When terminating an employee without just cause, employers must provide severance pay, which includes three months’ salary plus 20 days’ salary for each year of service, among other compensations.

Legal Implications

Failing to pay these mandatory benefits can lead to legal actions against the employer. Employees can file complaints with labor authorities, which may result in fines and penalties. For instance, not providing the statutory vacation days or the corresponding vacation premium can lead to significant fines and legal claims from employees. The Mexican labor authorities are vigilant about these issues, and companies found violating these laws can face substantial financial penalties and damage to their business reputation.

Inflating Payroll for Tax Benefits

Inflating payroll for tax benefits is a fraudulent practice where employers deliberately overstate their payroll expenses to reduce their taxable income and thereby decrease the amount of taxes they owe. Here’s an in-depth explanation of how this scheme works and its implications:

How Inflating Payroll Works

Fictitious Employees: Employers may create fictitious employees and add them to the payroll. By doing so, they can claim higher payroll expenses, which reduces their reported profits and, consequently, their tax liabilities.

Exaggerated Salaries: Employers might report exaggerated salaries for actual employees. This includes inflating the wages of certain employees beyond what they actually earn.

False Bonuses and Commissions: Employers might report false bonuses and commissions that were never actually paid out. This can significantly increase reported payroll expenses.

Overstating Overtime: Reporting inflated overtime hours and pay is another common method. Employers may claim that employees worked more hours than they actually did, leading to higher payroll costs.

Detecting Inflated Payroll

Detecting inflated payroll typically involves thorough audits and financial reviews. Auditors look for discrepancies in payroll records, such as:

Comparison with Industry Standards: Auditors compare the company’s payroll expenses with industry standards and averages. Significant deviations may indicate fraudulent activities.

Employee Verification: Auditors verify the existence of employees listed on the payroll. This may involve cross-checking social security numbers, addresses, and contacting employees directly.

Payroll Reconciliation: Reviewing and reconciling payroll accounts with bank statements to ensure that reported payroll expenses match actual disbursements.

Legal Implications

Inflating payroll for tax benefits is illegal and can lead to severe consequences, including:

Fines and Penalties: Companies found guilty of inflating payroll can face substantial fines and penalties. These penalties can be significantly higher than the amount of tax evaded.

Criminal Charges: In severe cases, individuals involved in the fraud can face criminal charges, leading to imprisonment.

Reputational Damage: Companies caught engaging in payroll inflation can suffer reputational damage, which can affect their business relationships and customer trust.

Back Taxes: The company will be required to pay back taxes with interest, which can lead to significant financial strain.

Ghost Employees

Ghost employees are fictitious individuals added to the payroll by fraudsters to collect undeserved salaries. This type of payroll fraud is particularly prevalent in larger organizations where payroll oversight might be less stringent. Ghost employees do not contribute any work but draw regular salaries, which are collected by the perpetrator.

How Ghost Employee Schemes Work

Creation of Fake Records: Fraudsters with access to payroll systems can create fake employee records. This often involves generating a fictitious employee profile using personal identifiable information, sometimes from deceased individuals or non-existent persons.

Payroll Manipulation: The fraudster can then enter false time and attendance data for these ghost employees. Since they control the payroll process, they can ensure these ghost employees receive regular paychecks.

Direct Deposit Exploitation: In many cases, the fraudulent wages are directed to the fraudster’s bank account via direct deposit. Financial institutions typically do not verify if the account holder’s name matches the payroll recipient’s name, making this method easier to exploit.

Commission and Bonus Manipulation

Commission and bonus manipulation is a form of payroll fraud where employers alter sales figures or performance metrics to reduce the payout of commissions and bonuses. This unethical practice deprives employees of the compensation they have earned based on their performance, impacting their morale and financial well-being.

How Commission and Bonus Manipulation Works

Alteration of Sales Figures: Employers or managers might underreport the sales figures generated by employees to minimize the commission payouts. This can be done by modifying sales records or by reallocating sales credits.

Adjustment of Performance Metrics: Performance metrics such as targets, quotas, or performance appraisals can be manipulated to show that employees did not meet the required standards for bonuses. This includes inflating the targets after they have been set or downgrading the performance ratings.

Timing of Bonus Payments: Delaying bonus payments or changing the bonus structure retroactively can also be a method to manipulate payouts. This may involve setting new conditions or timelines that are difficult to achieve.

Misclassification of Transactions: Transactions may be reclassified or categorized differently to reduce the commissionable value. For instance, a high-margin sale might be reported as a low-margin one to decrease the commission.

Third-Party Payroll Scams

Third-party payroll scams in Mexico involve fraudulent activities conducted by payroll service providers (PSPs) or other third-party entities responsible for managing payroll functions on behalf of companies. These scams can take various forms, including embezzlement of funds, failure to pay employees on time, and neglecting to make necessary tax contributions.

Types of Third-Party Payroll Scams

Embezzlement of Payroll Funds: Fraudulent payroll service providers may divert payroll funds meant for employees into their own accounts. This can result in employees not receiving their salaries and the employer being unaware until it is too late.

Failure to Pay Employees: Some payroll service providers might fail to disburse payments to employees on time or at all. This can cause significant financial distress to employees and legal complications for employers.

Neglecting Tax Contributions: Another common scam involves the payroll service provider failing to make required tax contributions to government agencies, such as the IMSS (Mexican Social Security Institute) and the tax authorities. This can lead to substantial fines and penalties for the employer.

Unauthorized Changes to Payroll Data: Scammers might change direct deposit information or mailing addresses to divert funds. Employers may not realize these changes until employees report missing payments.

False Reporting: Payroll providers may falsify reports, showing higher payroll costs or incorrect employee information to benefit financially.

How to Protect Against Third-Party Payroll Scams

Thorough Vetting: Conduct extensive background checks and vetting processes before hiring a payroll service provider. Verify their credentials, reputation, and references.

Regular Audits: Implement regular audits of payroll records to detect any discrepancies or fraudulent activities. This can help identify issues early before they escalate.

Direct Communication: Maintain direct communication with the payroll service provider and request regular updates and reports on payroll and tax activities.

Legal Agreements: Ensure all agreements with payroll providers are legally binding and include clauses that hold the provider accountable for any fraudulent activities.

Payroll Subcontracting Laws

In April 2021, Mexico implemented significant reforms to its labor laws, particularly affecting outsourcing and subcontracting practices. These changes were aimed at preventing the misuse of subcontracting to avoid paying full benefits to employees and ensuring better labor conditions.

Key Provisions of the Amendment:

Ban on Personnel Outsourcing: Employers are no longer allowed to outsource personnel for core business activities. This applies to any entity providing employees to be supervised by a third party while performing essential company functions.

Specialized Services Exception: Subcontracting is permitted only for specialized services that are not part of the company’s core business activities. These services must be registered with Mexico’s Tax Administration Service (SAT) and require strict compliance with labor and tax obligations.

Employment Agencies: Employment agencies can only participate in the recruitment, selection, and training of candidates. The hiring must be conducted directly by the company requiring the employees.}

Profit-Sharing Cap: The reform introduces a cap on profit-sharing, limiting it to three months’ salary or the average of the profit-sharing received in the past three years, whichever is higher.

Obligations for Companies:

For Subcontracting Companies:

- Obtain and renew a registration certificate from the Ministry of Labor and Social Welfare (STPS) every three years.

- Execute a contract for the provision of specialized services.

- Submit quarterly reports to the IMSS and INFONAVIT detailing the specialized services provided.

- Provide contractors with necessary documentation, including tax receipts and proof of social security contributions.

For Contracting Companies:

- Ensure that the specialized services contracted are not part of the core business.

- Verify the subcontractor’s registration with STPS.

- Collect copies of the subcontractor’s registration certificate, tax receipts, and proof of social security contributions.

Consequences of Noncompliance:

Noncompliance with these regulations can result in substantial fines, criminal liability for fraud, and joint liability for labor, social security, and tax obligations.

Manipulating Contract Information

In Mexico, manipulating contract information to avoid paying full severance benefits is a tactic some employers might use to reduce their financial obligations during the termination process. This manipulation can involve various unethical practices such as.

Changing Employment Terms: Employers may alter the terms of an employee’s contract, especially concerning the duration of employment and the nature of the job role. By doing this, they can claim that the employee does not meet the criteria for full severance benefits.

Misrepresenting Duration of Employment: Employers might falsely represent the length of time an employee has worked for the company. This misrepresentation can significantly impact the severance pay calculations, as severance in Mexico typically depends on the length of service.

Underreporting Wages: Employers may report lower wages to authorities, such as the Mexican Social Security Institute (IMSS), than what is actually paid to employees. This reduces the employer’s contributions to social security and other benefits, effectively lowering their payroll expenses. For employees, this means lower benefits related to social security, pensions, and healthcare.

Falsifying Reasons for Termination: Employers may provide false reasons for terminating an employee, categorizing the termination as “for cause” rather than “without cause.” Termination for cause usually requires specific and substantial reasons, such as gross misconduct or repeated offenses, which do not necessitate full severance payments. By doing this, employers aim to avoid paying the standard severance package which includes 90 days of salary, 12 days of salary per year worked, and additional payments depending on seniority and specific circumstances.

Employers hiring in Mexico must adhere to strict labor laws designed to protect employees’ rights. The laws ensure that employees receive fair compensation when their employment is terminated without just cause.

Any attempt to manipulate contract information can lead to significant legal risks and penalties for the employer, including fines and litigation costs. Employers found guilty of such practices may face penalties from the labor authorities and potential lawsuits from affected employees, which can result in costly settlements and damage to the company’s reputation.

Ensure compliance with labor laws

Employer payroll fraud is a significant challenge in Mexico, with various tactics employed to exploit the system. Understanding these fraudulent activities is crucial for employers and authorities to take preventive measures and ensure compliance with labor laws.

From misclassifying employees to inflating payroll expenses, each type of fraud carries severe legal and financial repercussions. Employers must be vigilant and proactive in maintaining accurate payroll records, reporting correct wages, and ensuring all mandatory benefits are paid in full. Failing to do so not only risks substantial fines and legal action but also damages the employer’s reputation and employee morale.

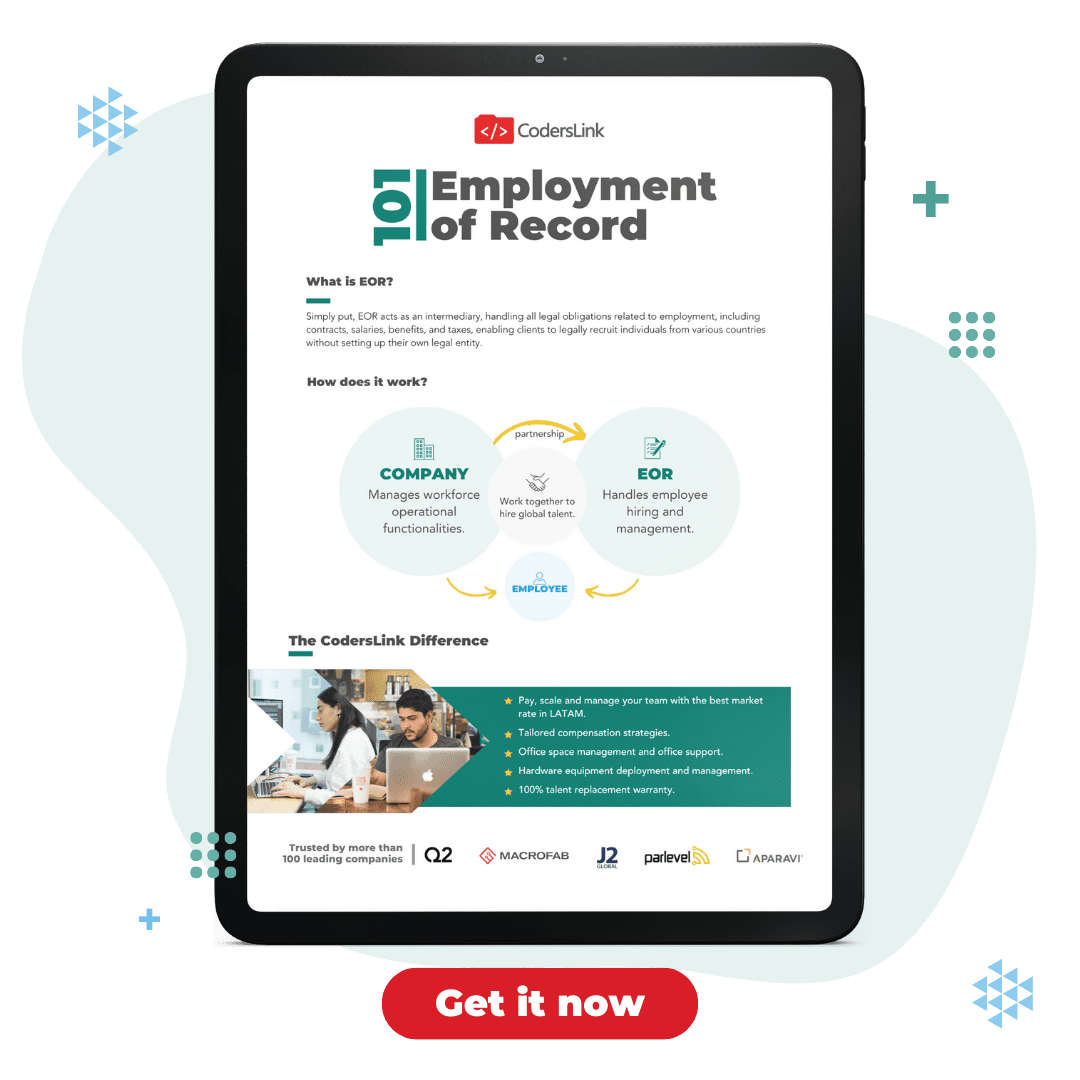

For companies nearshoring and expanding tech teams in Mexico, CodersLink offers extensive expertise in compliance and payroll management. By partnering with CodersLink, businesses can navigate the complexities of Mexican labor laws and focus on growth and innovation. CodersLink’s comprehensive services include ensuring correct employee classification, accurate payroll reporting, and adherence to all mandatory benefits, helping employers mitigate risks and maintain a compliant and fair working environment.

Sources

International Labour Organization (ILO): Provides information on labor practices and regulations in Mexico.

Mexican Social Security Institute (IMSS): Official guidelines and updates on social security contributions and compliance.

Mexican Federal Labor Law: Detailed regulations governing employment contracts, wages, and benefits in Mexico.