As the demand for software developers continues rising globally, nearshore regions with similar time zone like Latin America offer immense tech talent potential. Hence, the North American firms can tap in cost-effectively. In particular, Mexico presents an unparalleled opportunity to hire software programmers given the sheer size of its talent pool and proximity benefits for U.S. companies.

With over 130,000 science and tech university graduates per year and counting, Mexico produces more than enough homegrown engineering talent to serve both the needs of its own companies as well as American firms looking to augment staff. This burgeoning talent pipeline owes much to the emphasis Mexico places on STEM education from an early stage through university.

The technical abilities of Mexican developers also continue rising rapidly as new languages like Python and frameworks like React and Node.js now supplement traditional skills in Java and .NET. This ensures Mexican programmers stay on the cutting edge and offer the exact skills demanded by innovative U.S. firms.

When combining a sheer abundance of talent with low wages by American standards and Mexico’s cultural affinity with the U.S., the strategic benefits become very apparent.

Whether seeking an offshore center just a 2-hour flight away or localized knowledge to build products for the Latin American market, savvy American companies are already tapping into Mexico’s developer bounty.

This article will analyze the specific strengths Mexico provides in greater detail, while also providing strategies to mitigate common challenges like language barriers that can emerge. Altogether, U.S. companies that leverage Mexico’s software engineers early on will gain a decisive digital edge over the coming decade.

Economic Growth and Tech Expansion in Mexico

Over the last decade, Mexico has stabilized macroeconomic conditions with controlled inflation, public spending discipline and openness to foreign trade and investment. Under President Andrés Manuel López Obrador, the economy has steadily grown around 2-3% annually pre-pandemic.

The administration’s National Development Plan prioritizes deploying infrastructure upgrades that widen internet access, a prerequisite for tech adoption. Private and public initiatives to nurture homegrown startups and attract tech investment have also accelerated, concentrating in cities like Mexico City, Guadalajara, Monterrey, and Merida.

Educational Developments

In line with Mexico’s rapidly growing technology sector, higher education institutions have expanded engineering and computer science programs enormously over the past decade. The Mexican government has provided strong support through large scholarship initiatives like Youth Building the Future, which sponsors tech skill development for students.

Top universities including the Monterrey Institute of Technology, National Autonomous University of Mexico, Anahuac University, and La Salle University now produce over 130,000 engineering graduates every year. This matches the standards of top American universities, creating a vast tech talent pipeline.

Specific technology specializations have also grown over 10x in Mexico’s university system over the last 10 years as demand rises. Software engineering, computer systems, mechatronics, and video game development are particularly popular degree choices today.

With great government backing and Mexico’s youth recognizing the abundant tech sector jobs awaiting them, this educational foundation will only continue expanding – allowing remote developers in Mexico to scale further while retaining skill quality.

Technological Advancements and Adoption

Mexico has made significant strides in digital connectivity, positioning itself as a leader in technological adoption in Latin America. With over 80 million internet subscribers, the country has one of the highest consumer technology adoption rates in the region.

This extensive internet penetration is largely due to aggressive governmental initiatives, particularly the National Connectivity Plan, which aims to achieve universal broadband access by 2024.

This plan is part of a broader strategy to ensure that digital connectivity reaches all corners of the country, enabling more citizens to access the internet and digital services, thus fostering an inclusive digital society.

Contributing Factors to Mexico City’s Tech Ascendancy

Several factors contribute to Mexico tech industry’s emergence as a leading tech hub. Firstly, the city benefits from a robust educational infrastructure that produces thousands of tech-savvy graduates each year, who are well-versed in the latest technological innovations and programming languages. Universities and technical institutes in Mexico City have aligned their curriculums with industry demands, emphasizing skills that are crucial in the tech sector, such as artificial intelligence, machine learning, and big data analytics.

Secondly, government policies supporting tech entrepreneurship and innovation have played a crucial role. These include fiscal incentives for tech startups, grants for research and development, and investments in tech parks that provide the necessary infrastructure for tech companies to thrive. Moreover, international events and tech summits hosted in the city have further solidified its reputation as a tech nucleus, attracting both investors and talent to the region.

Impact of High Technology Adoption

The adoption of technology in Mexico has left a strong impression on the different sectors of the economy. For businesses, it has meant the expansion of their online presence and establishing such a connection with customers via the platforms.

It has created new opportunities for learning and collaboration across traditional classroom borders, thus, for the education sector. The health sector has embraced telemedicine as an innovation that has significantly improved service delivery in remote locations.

As a result of that, the tech industry has been the source of job creation, not only inside the tech industry but also in other sectors such as marketing, business development, and customer service. This economic stimulus is of course propelling the living standard and is also contributing to the Mexican economy’s overall growth.

Benefits of Hiring Tech Talent in Mexico

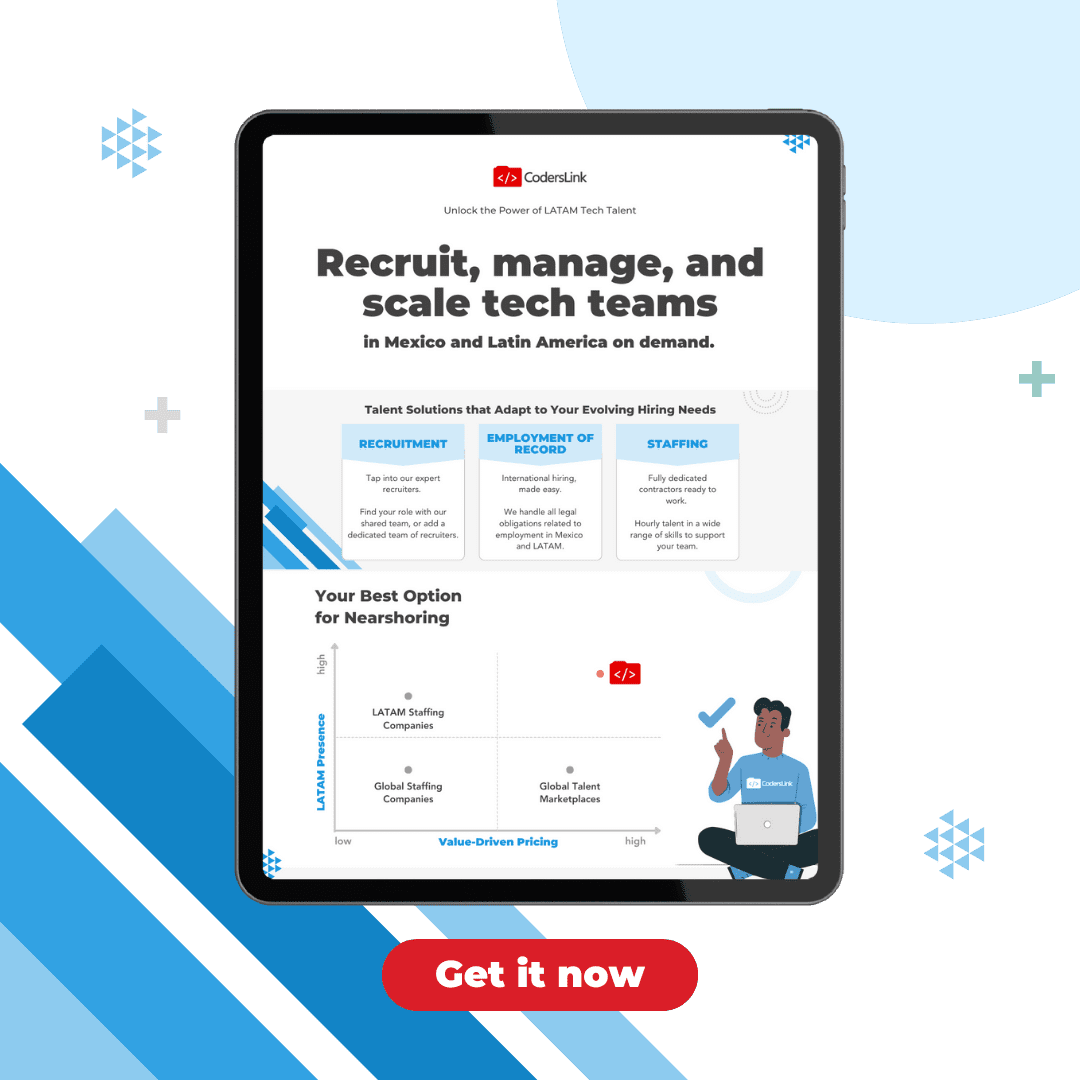

Mexico has been recognized as the most preferred destination by the US when it comes to outsourcing software development. The fact is that a vast number of Mexican developers get paid much less than their American counterparts, and it is this difference that offers a great solution to cost optimization.

Unbeatable Value Proposition

The value ramifications of Mexican software talent are twofold, and they are associated with cost savings and proximity. The mean salary for a junior-level developer in Mexico is around $30,000 to $45,000, while in the US the figure is $110,000. This 60% reduction in labor cost enables the companies to do more with less, freeing them up for other issues.

Moreover, Mexico is adjacent to the southern US, with many tech centers being less than 3 hours by air. This short distance thus facilitates commuting for in-person collaboration when necessary. The US next door is advantageous because of the low-cost talent, which it makes Mexico the most favored place.

Abundant Talent Pool

A great advantage to Mexico stems from the vast labour pool that makes it a viable offshore development centre. Every year at least 130,000 STEM graduates are added to the job market and the number of students enrolling in technical universities is also growing – thus, the supply is plentiful.

The most prestigious schools like the National Autonomous University of Mexico can graduate thousands of qualified developers who can work across different software languages like Java, JavaScript, C# and so on. In addition to that, a lot of graduates have proficiency of English – and thus the interaction with the US partners is not a big obstacle.

This emerging pool of talent enables US businesses to effortlessly identify and incorporate developers into the staff according to the project requirements. As the demand for a larger Mexican talent pool increases, the abundance of Mexican developers provides an effortless option for headcount growth.

Crystal Clear Choice

Altogether, the numbers and trajectory solidify Mexico’s rise as the ideal nearshore delivery location. The software market in Mexico is projected to grow by 4.23% annually from 2024-2028, reaching a market volume of $4.91 billion in 2028.

US companies seeking to optimize budgets without compromising on technical quality or delivery oversight have an unambiguous choice in Mexico’s talent pool. The proximity and value proposition simply can’t be matched elsewhere.

By tapping into Mexico’s rich developer ecosystem, enterprises can simultaneously cut costs and accelerate digital initiatives. The efficiency unlock is set to ripple through Mexico’s partnering US firms for years to come.

Challenges and Considerations

While Mexico presents copious software engineering talent, fully capitalizing on this does entail overcoming some initial hurdles.

Language Barriers

The predominant challenge is contending with language barriers, as English fluency varies amongst Mexican developers. Having bilingual coordinators on the US side helps relay instructions and information.

Google Translate and other tools also assist in translating documents when required. However, achieving seamless collaboration necessitates English language alignment.

Cultural Differences

There are also intercultural nuances regarding communication styles and workplace hierarchy. Mexicans tend to use subtle, non-confrontational language even in disagreement – contrasting the blunt American style.

They also come from a more hierarchical corporate culture valuing structure. Adjusting management approaches helps integrate these differences over time.

Legal Considerations

Navigating contracts, taxes, and regulations also takes guidance from HR consultants versed in Mexican law. But altogether, these hurdles are surmountable through bridging language gaps, recalibrating management tactics, and securing specialized legal help.

Fundamentally, any complications from utilizing Mexican talent are transitory. As teams align over months and years, language and culture fade as issues, while the technical and cost efficiencies endure.

So, while needing initial integration effort – having the right bilingual staff and HR knowledge – Mexico’s software engineering bounty remains an unmatched strategic asset.

Future Outlook

The demand for software developers in Mexico will almost certainly continue growing over the next decade. Mexico produces over 130,000 STEM graduates annually, providing a deep pool of junior talent. As more global tech firms tap this labor pool, it will incentivize Mexico’s youth to pursue tech careers and become senior developers later on. This cycle will further expand Mexico’s seasoned talent base.

At the same time, Mexico’s startup scene will mature – boosted by better access to VC funding. Accelerators like 500 Startups have already run programs in Mexico. As domestic startups flourish, they’ll retain local engineering talent rather than lose it overseas.

Government initiatives like the ProSoft 3.0 fund will also nurture technology hubs across cities like Monterrey, Guadalajara, and Mexico City. Combined with Mexico’s central US timezone, low wages relative to the US, and cultural affinity – it is primed to become a go-to development center.

Conclusion

This examination has shown Mexico’s rise as an IT services hub is no transitory phenomenon. The country produces copious developers with the aptitude to meet enterprise-grade requirements.

Language and cultural barriers are manageable through the use of bilingual staff and calibrated management tactics. Furthermore, Mexico’s geographic advantages will allow it to embed itself in global tech supply chains in the decade ahead.

For US companies and startups seeking to bolster engineering capacity – Mexico’s talent pool warrants serious consideration. The examples of breakout startups leveraging Mexican developers substantiate the strategic value of doing so.

Ultimately by tapping this blossoming resource, enterprises can gain a formidable technical edge over the competition.