The Aguinaldo, or the 13th-month salary, is a legally mandated Christmas bonus that employers must provide to their employees by December 20 each year. This isn’t merely a tradition but a legal obligation, serving as a financial benefit for employees. This guide helps tech companies and other employers understand the nuances of the Aguinaldo, ensuring compliance with Mexican labor laws.

Legality and Deadline

Mexican labor laws require the Aguinaldo to be paid by December 20. Failure to comply can result in significant fines, up to 5,000 times the legal daily minimum wage, underscoring the importance of meeting this obligation. The law ensures that employees receive fair compensation for their yearly work, reflecting Mexico’s commitment to worker welfare.

Aguinaldo Calculation

The Aguinaldo is equivalent to at least 15 days of an employee’s base salary. Here’s an example:

An employee with a yearly salary of $660,000 pesos is entitled to an Aguinaldo of $27,500 pesos.

Calculation: $660,000 pesos ÷ 12 months ÷ 2 = $27,500 pesos.

Employees who have worked less than a year receive a prorated Aguinaldo based on their time of service. Some companies may offer more generous bonuses, sometimes equating to 30 days of wages or a full 13th month of salary, making the Aguinaldo an attractive benefit for employees.

Taxation

The Aguinaldo is subject to income tax, but the first 30 days of the Aguinaldo are exempt from tax. This exemption provides some tax relief for employees, ensuring they receive a substantial portion of their bonus.

The legal minimum daily wage in Mexico as of October 2023 is 207.44 MXN, and 312.41 MXN in the Free Zone near the northern border.

Foreign Workers’ Eligibility

International employees with the appropriate employment documentation are also entitled to the Aguinaldo, ensuring equitable labor practices regardless of nationality.

Non-Compliance Consequences

Employers who fail to pay the Aguinaldo can face penalties ranging from 50 to 5,000 times the minimum wage. Employees can report non-compliance to the Federal Office of the Defense of Labor, ensuring that the legal consequences for employers are substantial and enforceable.

Economic Impact

The Aguinaldo boosts the economy by increasing retail spending during the holiday season. It also enhances employee loyalty and reduces turnover, benefiting employers by lowering recruitment and training costs. However, it can pose a financial challenge for struggling companies, highlighting the need for careful financial planning.

Aguinaldo in Other Nations

The Aguinaldo is common in many Latin American countries, with variations in payment schedules and conditions. Some European countries even offer a 14th-month pay, showing the global recognition of this employee benefit.

Reduced Aguinaldo Payments

The Aguinaldo amount is based on income, meaning lower earners receive a proportionally smaller bonus. This structure ensures fairness but also means that employees with lower wages receive less financial benefit.

Posthumous Aguinaldo Disbursement

In the event of an employee’s death, the Aguinaldo is paid to their named beneficiaries, reflecting the comprehensive nature of this legal provision.

By adhering to the Aguinaldo mandate, employers ensure a harmonious employer-employee relationship and compliance with Mexican labor laws.

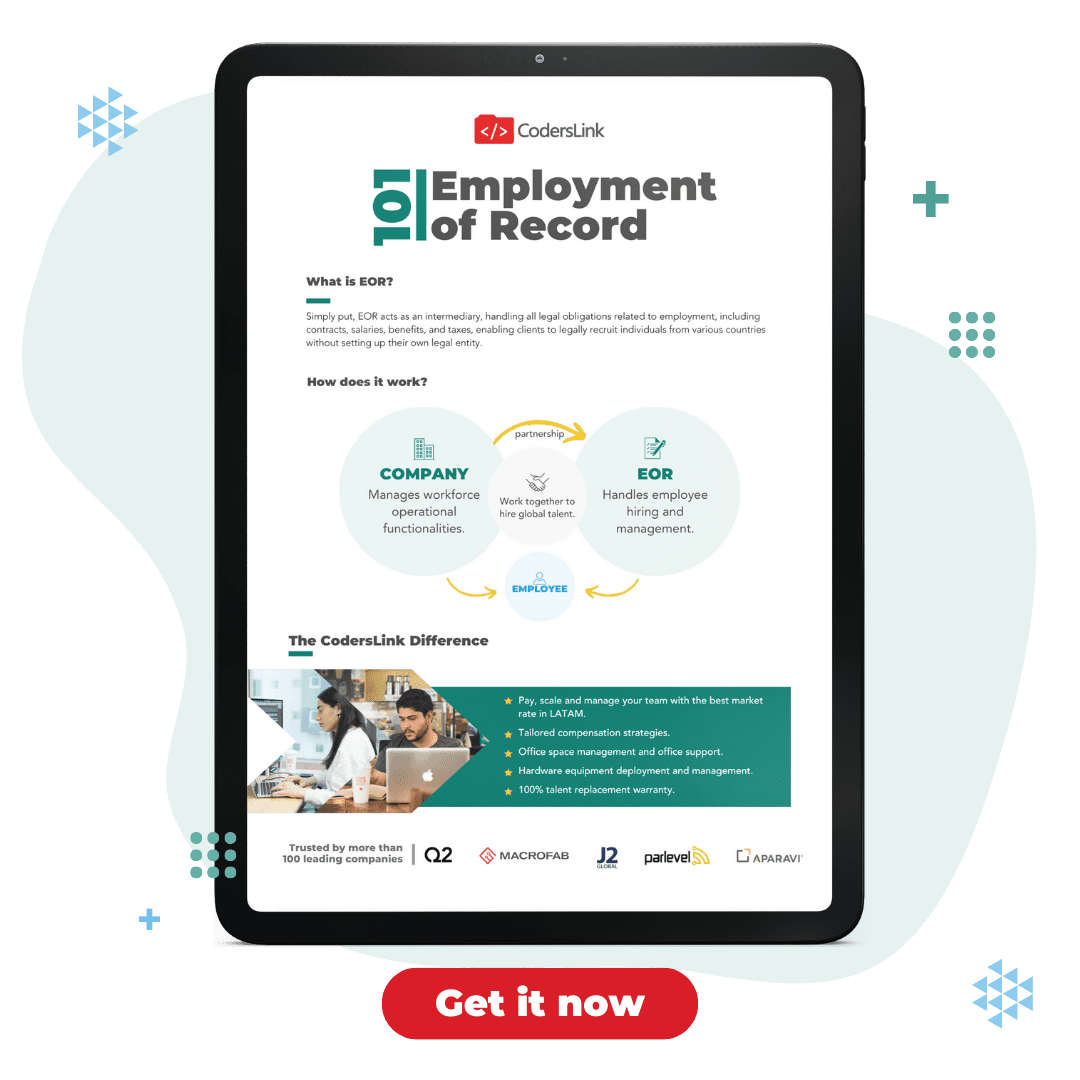

Manage Aguinaldo and Other Employee Benefits with CodersLink Solutions

For companies expanding their workforce in Mexico, CodersLink’s Employer of Record (EOR) services provide comprehensive solutions to manage payroll and compliance, including the timely payment of the Aguinaldo. Contact CodersLink today to streamline your payroll processes and ensure compliance with Mexican labor laws.

FAQ

What is the Aguinaldo?

The Aguinaldo is a mandatory annual Christmas bonus equivalent to at least 15 days of an employee’s base salary, paid by December 20 each year.

How is the Aguinaldo calculated?

The Aguinaldo is calculated as 15 days of the employee’s base salary. For example, if an employee’s monthly salary is 30,000 MXN, their Aguinaldo would be 15,000 MXN.

Are there tax exemptions for the Aguinaldo?

Yes, the first 30 days of the Aguinaldo are exempt from income tax, providing tax relief for employees.

What are the consequences of not paying the Aguinaldo on time?

Employers who fail to pay the Aguinaldo on time can face fines up to 5,000 times the legal daily minimum wage.

Are international employees entitled to the Aguinaldo?

Yes, international employees with appropriate employment documentation are entitled to the Aguinaldo.

How does the Aguinaldo impact the economy?

The Aguinaldo boosts the economy by increasing retail spending during the holiday season and enhances employee loyalty and retention.

What happens to the Aguinaldo in the event of an employee’s death?

In the event of an employee’s death, the Aguinaldo is paid to the employee’s named beneficiaries.

Glossary of Terms

- Aguinaldo: A mandatory annual Christmas bonus equivalent to at least 15 days of an employee’s base salary.

- Base Salary: The primary component of an employee’s pay, not including bonuses or overtime.

- Prorated: Adjusted according to the proportion of time worked.

- Federal Office of the Defense of Labor: The government body where employees can report non-compliant employers.

- Legal Daily Minimum Wage: The minimum amount per day that an employer must pay an employee as mandated by law.